All Categories

Featured

Table of Contents

- – Who has the best customer service for Annuity ...

- – Who should consider buying an Fixed Vs Variabl...

- – How can an Annuity Payout Options help me wit...

- – What is the most popular Fixed Indexed Annuit...

- – What are the top Variable Annuities provider...

- – How can an Income Protection Annuities prote...

For those willing to take a bit extra risk, variable annuities offer extra opportunities to expand your retired life possessions and possibly increase your retired life income. Variable annuities offer a variety of investment choices managed by expert money managers. Consequently, capitalists have a lot more flexibility, and can even move possessions from one option to one more without paying taxes on any financial investment gains.

* An instant annuity will certainly not have a build-up phase. Variable annuities provided by Safety Life insurance policy Firm (PLICO) Nashville, TN, in all states except New York and in New York City by Protective Life & Annuity Insurer (PLAIC), Birmingham, AL. Securities used by Investment Distributors, Inc. (IDI). IDI is the major expert for signed up insurance coverage items provided by PLICO and PLAICO, its affiliates.

Financiers should carefully think about the financial investment objectives, risks, costs and costs of a variable annuity and the underlying financial investment choices prior to investing. This and various other info is had in the prospectuses for a variable annuity and its hidden financial investment choices. Prospectuses might be obtained by contacting PLICO at 800.265.1545. An indexed annuity is not a financial investment in an index, is not a security or securities market financial investment and does not join any supply or equity investments.

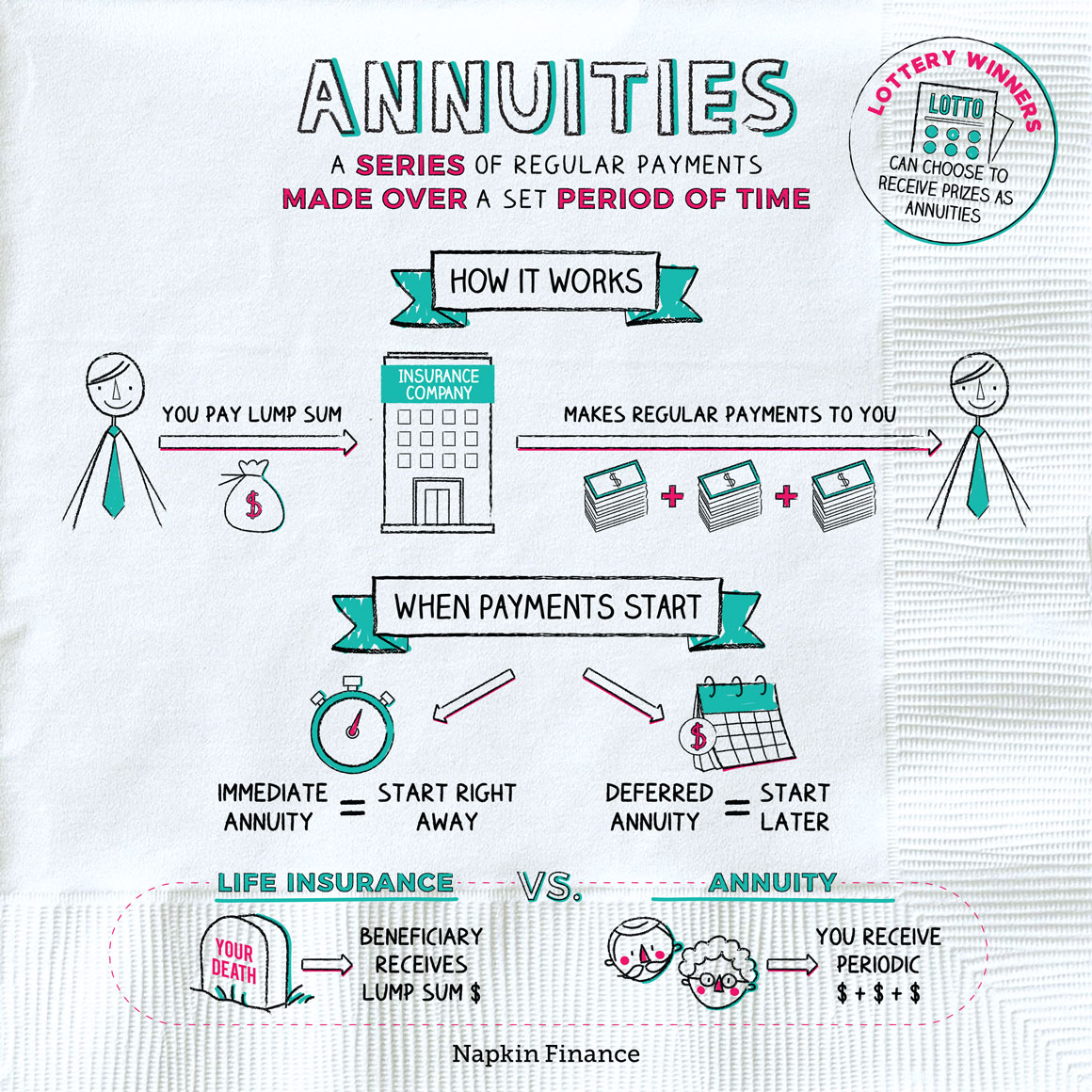

What's the distinction between life insurance coverage and annuities? The lower line: life insurance policy can aid offer your loved ones with the monetary tranquility of mind they deserve if you were to pass away.

Who has the best customer service for Annuity Riders?

Both need to be considered as part of a lasting economic plan. Both share some similarities, the overall purpose of each is extremely different. Let's take a peek. When comparing life insurance coverage and annuities, the most significant difference is that life insurance policy is developed to assist secure versus an economic loss for others after your death.

If you desire to discover also more life insurance coverage, read up on the specifics of exactly how life insurance policy functions. Think about an annuity as a tool that can aid fulfill your retired life demands. The primary purpose of annuities is to produce earnings for you, and this can be done in a few various ways.

Who should consider buying an Fixed Vs Variable Annuities?

There are lots of possible benefits of annuities. Some include: The ability to expand account value on a tax-deferred basis The possibility for a future earnings stream that can't be outlasted The opportunity of a round figure advantage that can be paid to a surviving partner You can buy an annuity by giving your insurance coverage business either a solitary round figure or paying over time.

Individuals typically get annuities to have a retired life income or to develop savings for one more objective. You can get an annuity from an accredited life insurance coverage agent, insurance provider, economic organizer, or broker. You must chat to a monetary advisor about your requirements and objectives prior to you get an annuity.

How can an Annuity Payout Options help me with estate planning?

The distinction between the 2 is when annuity repayments start. enable you to save money for retirement or other reasons. You don't need to pay tax obligations on your revenues, or contributions if your annuity is a specific retired life account (IRA), until you take out the earnings. allow you to create an earnings stream.

Deferred and prompt annuities offer a number of options you can pick from. The alternatives give various levels of potential risk and return: are guaranteed to earn a minimal passion price.

Variable annuities are greater risk due to the fact that there's an opportunity you can lose some or all of your money. Set annuities aren't as risky as variable annuities since the financial investment danger is with the insurance policy firm, not you.

Fixed annuities assure a minimal rate of interest rate, typically between 1% and 3%. The firm might pay a greater rate of interest price than the ensured passion rate.

What is the most popular Fixed Indexed Annuities plan in 2024?

Index-linked annuities reveal gains or losses based upon returns in indexes. Index-linked annuities are more intricate than taken care of deferred annuities. It is very important that you comprehend the attributes of the annuity you're considering and what they suggest. Both contractual attributes that affect the amount of passion credited to an index-linked annuity the most are the indexing approach and the engagement rate.

Each counts on the index term, which is when the business determines the interest and credit scores it to your annuity. The determines just how much of the boost in the index will certainly be utilized to compute the index-linked passion. Other essential attributes of indexed annuities include: Some annuities cap the index-linked rate of interest.

Not all annuities have a floor. All dealt with annuities have a minimal guaranteed worth.

What are the top Variable Annuities providers in my area?

The index-linked rate of interest is included in your original costs amount but does not substance during the term. Various other annuities pay substance passion throughout a term. Substance passion is rate of interest made on the money you conserved and the rate of interest you gain. This means that passion already attributed also gains rate of interest. The rate of interest made in one term is generally intensified in the following.

If you take out all your money prior to the end of the term, some annuities will not credit the index-linked rate of interest. Some annuities may credit just component of the rate of interest.

How can an Income Protection Annuities protect my retirement?

This is since you bear the investment risk instead of the insurer. Your agent or economic adviser can help you choose whether a variable annuity is right for you. The Stocks and Exchange Payment classifies variable annuities as safety and securities since the performance is derived from stocks, bonds, and various other financial investments.

An annuity agreement has 2 stages: an accumulation stage and a payout stage. You have several options on just how you add to an annuity, depending on the annuity you acquire: allow you to pick the time and amount of the settlement.

Table of Contents

- – Who has the best customer service for Annuity ...

- – Who should consider buying an Fixed Vs Variabl...

- – How can an Annuity Payout Options help me wit...

- – What is the most popular Fixed Indexed Annuit...

- – What are the top Variable Annuities provider...

- – How can an Income Protection Annuities prote...

Latest Posts

Analyzing Variable Annuity Vs Fixed Indexed Annuity A Comprehensive Guide to Investment Choices What Is Fixed Vs Variable Annuity? Benefits of Choosing the Right Financial Plan Why Fixed Index Annuity

Decoding Variable Vs Fixed Annuity A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Choosing the Right Financial Stra

Analyzing Fixed Index Annuity Vs Variable Annuities Key Insights on Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why C

More

Latest Posts